Analysis

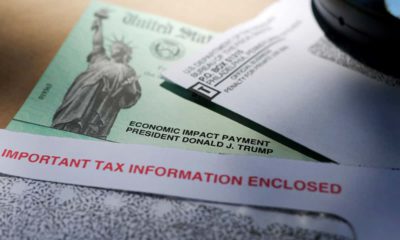

Did Tax Reform Put More Money in Your Paycheck?

Published

7 years agoon

By

Drew Phelps

Have you seen more money in your paycheck this month? It could be due to the tax cuts passed in late December.

The Internal Revenue Service released its revised withholding tables last month and essentially all businesses were expected to comply by the end of February.

News Analysis

Drew Phelps

Reports have varied, due in part to differences in withholding formulas between companies.

Trump Delivers on Promise

To see if people in Fresno were receiving their boost – and making the connection that it came from the tax cut – I decided to interview patrons of Fashion Fair mall.

Though this sampling is not scientific, Fashion Fair offers a diverse cross-section of Fresnans. As a result, I assumed, responses from patrons would likely reflect the general sentiment of Fresno’s middle class – the group at which, Republicans argued, tax reform was aimed.

The outcome seemed to reflect that goal, judging by the range of responses.

A few provided positive reviews.

A woman named Eileen said that, after paying attention to the news about the tax cuts, she watched her paycheck this month and noticed the change: about $70. She attributed the new law to Trump’s leadership.

“Trump promised more pay for people like me and he delivered,” she said, smiling.

Not Enough Extra Money To Really Help

One man who declined to state his name told me that he too had been monitoring the news for when the withholding cuts would come into effect.

“I got $10 more, give or take,” he explained.

When asked about his seeming displeasure with that amount, he voiced his concerns:

“I understand that I’ll receive less than higher earners because they make more in the first place, but this amount for an average guy just doesn’t seem right. It’s hardly going to help at all.”

Most people I spoke with were unaware that there had been any change in their take-home pay. A few decided to check their bank account or paycheck apps on their phones after I asked.

“Hey, there’s $20 more than usual,” said a woman named Sylvia after viewing her account. “I’m not complaining about extra cash, but it won’t buy too much.”

GV Wire’s Bill McEwen received a similar response when he posed the question on Twitter.

User @VoxGenevieve tweeted: “My check went up $30.97 a month. Considering 1/3 of my check goes to my mortgage, it won’t make enough of a difference to say my [quality] of life has improved. No change in voter preference,” adding, “I will vote against Nunes & GOP because I really don’t think that they care.”

CNN Coverage Reflects Mixed Bag

CNNMoney inquired with payroll service provider ADP in their report. ADP projects a rise of between $40 and $190 per paycheck for individual filers earning between $46,000 and $162,000 annually.

“For instance, someone making $57,000 may see roughly $60 more per paycheck. If she grosses $162,000, her take-home pay could rise by $190,” writes CNN’s Jeanne Sahadi.

Along the same lines, married filers making between $51,000 and $167,000 will likely see jumps of $30 to $172 more in take-home pay per check.

“So, for example, a joint filer making $61,000 might see an extra $40 every two weeks. If he grosses $114,000, his net pay could rise by $115 every two weeks,” Sahadi wrote.

The article also highlights the many variables that could contribute to differing withholding amounts – since tax cuts were not the only changes that took effect at the beginning of the year.

The CNN story notes that state and local tax changes or differences in healthcare deductions also affect paychecks, so not everyone’s tax reduction will be clear.

Politico Poll Proves Mixed Reviews

Politico/Morning Consult poll results released this week seem to back up the belief that some changes may not be noticed, either due to other alterations in withholding or simply not receiving enough additional net pay to recognize.

According to their survey, 25% of registered voters said they noticed an increase in their take-home pay.

A substantial amount — 51% — reported noticing no difference, while 24% said they did not know if they received an increase.

As the ADP estimates outline, it was more likely for higher earners to notice extra cash.

“Our polling shows high-income earners are more likely to have noticed an increase in their paychecks as a result of the tax bill,” said Kyle Dropp, Morning Consult’s co-founder and chief research officer. “For example, 40 percent of voters who earn more than $100,000 said they have noticed a pay increase in the past several weeks. In contrast, 33 percent of voters who earn between $50,000 and $100,000 and 16 percent of voters who earn under $50,000 said the same.”

So overall, the results are mixed at this early stage. The true test of the tax bill’s impact for individuals will come in April 2019.

You may like

-

Fox, Newsmax Shoot Down Their Own Aired Claims on Election

-

Pressure Mounts, Rifts Emerge at Fox News Over Election

-

Fox News Anchors Quarantine After Virus Exposure on Flight

-

Inmates Eligible for $1,200 Stimulus Payments, Says Judge

-

FOX, C-SPAN, NBC Moderators for Upcoming Trump-Biden Debates

-

White House Drops Payroll Tax Cut After GOP Allies Object